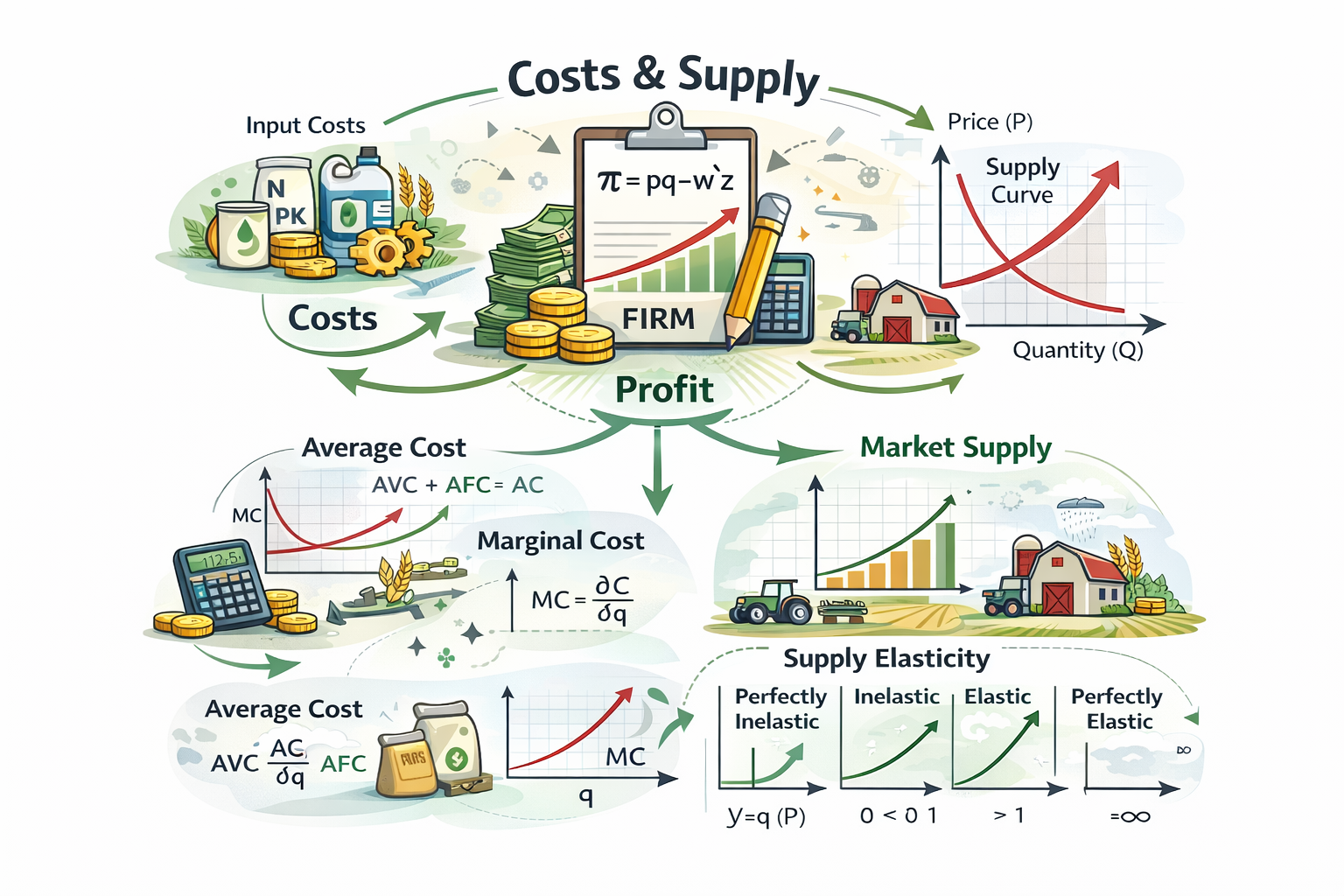

class: center, middle, inverse, title-slide .title[ # Agricultural Markets ] .subtitle[ ## Lecture 3: Costs and Supply ] .author[ ### David Ubilava ] .date[ ### University of Sydney ] --- # Firms maximize profit .pull-left[  ] .pull-right[ - Much like consumers are utility-maximizers, firms are profit-maximizers. - For a firm producing a product, `\(q\)`, using a set of inputs, `\(\mathbf{z}=(z_1,\ldots,z_k)'\)` , the short-run profit is defined as: `$$\pi = pq-w'z,$$` where `\(p\)` is a unit price of `\(q\)`, and `\(\mathbf{w}=(w_1,\ldots,w_k)\)` is a vector of input costs. ] --- # Production function .right-column[ - A firm's output is related to inputs via a production function: `$$q = q(\mathbf{z})$$` - We can, thus, rewrite he profit function as: `$$\pi = pq(\mathbf{z})-\mathbf{w}'\mathbf{z}.$$` - We can use this equation to derive a producer's supply function of output and demand functions for inputs. <!-- The relevant supply function depends on the form of the production function, hence the form of the cost functions. --> ] --- # Marginal product of input .right-column[ - A producer maximizes profits by using each input up to the point where the last unit just pays for itself. - Optimal use of inputs is determined with respect to the (known) production function. - The functional form of production is such that output is increasing with input, but at a decreasing rate. - The rate at which output increases is referred to as the *marginal product* of input: `$$MP_i=\frac{\partial q}{\partial z_i}$$` ] --- # The optimal amount of input .right-column[ - The optimum level of factor use is at the point where the `\(MP_i\)` multiplied by price of output, `\(p\)`, just equals to the unit cost of input, `\(w_i\)`, which yields the following relationship:$$\frac{\partial q}{\partial z_i} = \frac{w_i}{p}$$ - This relationship implies that an increase of the input cost, will lead to reduced use of that input and lower output, *ceteris paribus*. - Moreover, optimal factor use will change only with an increase or decrease in relative prices. ] --- # Firm's costs and supply .pull-left[ A firm's costs, `\(C(q)\)`, consist of fixed costs, `\(F\)`, that don't change in the short run, and variable costs, `\(V(q)\)`, that change with output. Average costs: `\(\frac{C(q)}{q}=\frac{F}{q}+\frac{V(q)}{q}\)` Marginal cost: `\(MC=\frac{\partial C(q)}{\partial q}\)` ] .pull-right[ <img src="03-Supply_files/figure-html/demand-1.png" width="90%" /> ] --- # Economies of scale .right-column[ - *Economies of scale* happen when average total cost decreases as output increases, i.e. when the marginal cost curve is below the average total cost curve. - *Diseconomies of scale* happen when average total cost increases as output increases, i.e. when marginal cost is above the average total cost curve. ] --- # A measure of economies of scale .right-column[ - A measure of economies of scale, `\(s\)`, is the average total cost to marginal cost ratio, which is equivalent to the total cost elasticity of output: `$$s=\frac{AC(q)}{MC(q)} \equiv \frac{\partial q}{\partial C(q)} \frac{C(q)}{q}$$` - We have increasing returns to scale (i.e., economies of scale) when `\(s>1\)`, decreasing returns to scale (i.e., diseconomies of scale) when `\(s<1\)`, and constant returns to scale when `\(s=1\)`. ] --- # Market supply .right-column[ - Market supply is a (horizontal) sum of firm's supply curves. - Assuming `\(n\)` identical firms, each producing `\(q\)` units of optimal output, the aggregate market supply is `\(Q = nq\)`. The supply curve, generally, is upward sloping, which is inferred in the *law of supply*. ] --- # The supply mover and shifters .right-column[ - Own price of a good is a sole factor affecting the quantity supplied resulting in the movement along the supply curve. - All other factors *shift the supply curve*. Such factors can be: * prices of inputs; * prices of related goods (e.g., palm oil and soybean oil); * goods competing for the same factors of production (e.g., the land used to produce corn and soybeans); * joint production of goods (e.g., soybean meal and soybean oil); * factors affecting production costs and output quantities; * production risks (e.g., weather-related); * taxes and subsidies. ] --- # Supply elasticity .right-column[ - The responsiveness of the supply to price changes is known as *price elasticity of supply* (supply elasticity). - Mathematically, supply elasticity is given by: `$$\eta = \frac{\partial Q}{Q}/\frac{\partial P}{P} \equiv \frac{\partial Q}{\partial P}\frac{P}{Q}$$` ] --- # Supply elasticity .right-column[ - Supply elasticities can be categorized as: * Perfectly inelastic (vertical line): the elasticity measure of zero. * Inelastic: the elasticity measures between `\(0\)` and `\(1\)`. * Elastic: the elasticity measures greater than `\(1\)`. * Perfectly elastic (horizontal line): the elasticity measure of `\(\infty\)`. - In the very short run, agricultural supply elasticity is nearly zero; as the time-frame increases, producers are able to react to price changes and, thus, the supply elasticity increases. ] --- # Supply elasticity .right-column[ - Assuming a linear supply curve, as quantity and price increase (i.e., as we move upwards along the supply curve) the price elasticity of supply converges to `\(1\)`. - Moreover, if a linear supply curve intersects with the origin, the elasticity of supply is always `\(1\)`. ] --- # Readings .pull-left[  ] .pull-right[ Tomek & Kaiser, Chapter 4 [Masters & Finaret, Chapter 2](https://link.springer.com/chapter/10.1007/978-3-031-53840-7_2) (Sections 2.2 & 2.3) ]