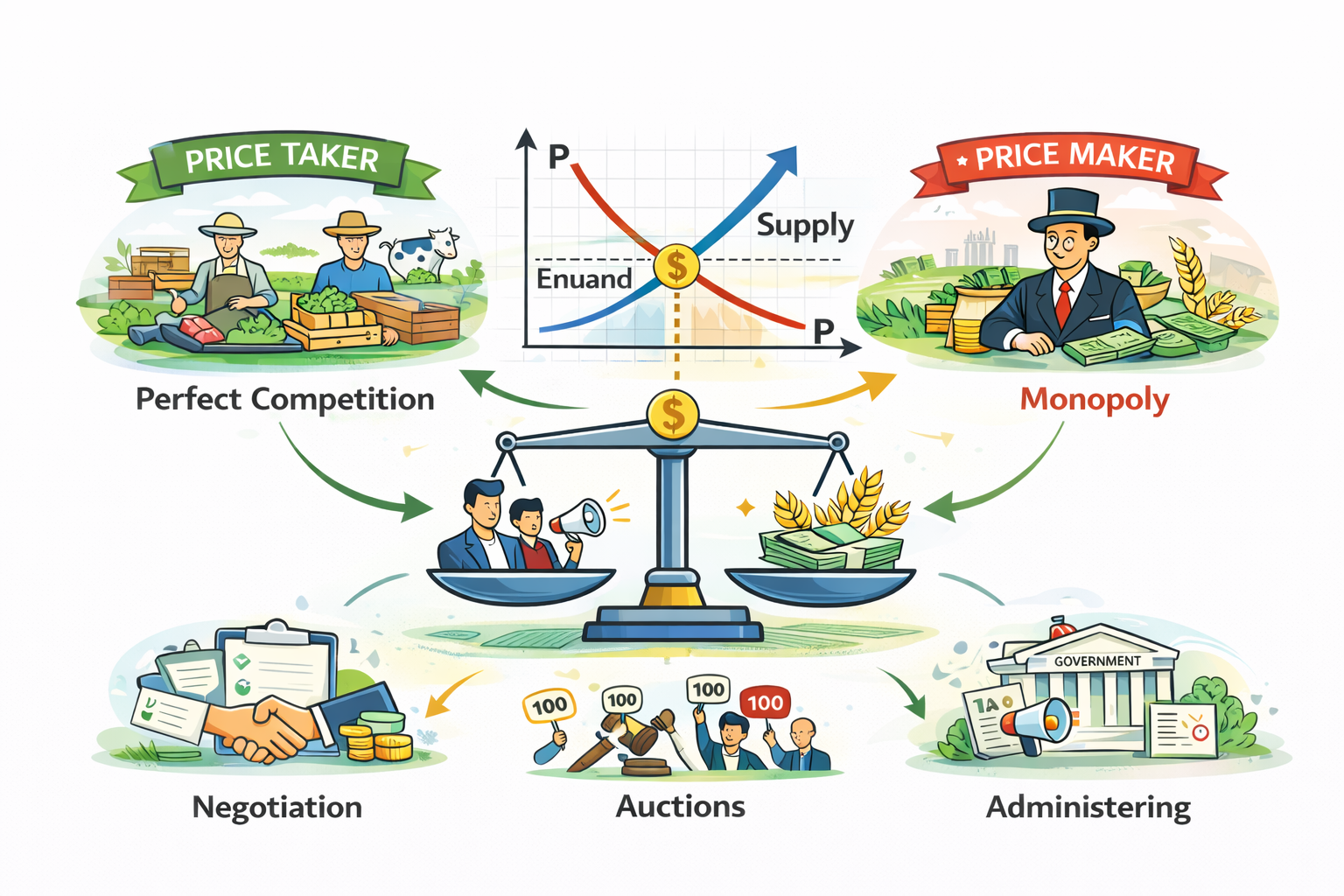

class: center, middle, inverse, title-slide .title[ # Agricultural Markets ] .subtitle[ ## Lecture 4: Market Structure and Price Determination ] .author[ ### David Ubilava ] .date[ ### University of Sydney ] --- # Market Structure .pull-left[  ] .pull-right[ - Markets are commonly classified in relation to the number of sellers, assuming many buyers. - Under such classification, four general types of markets are considered: * Perfectly competitive (many sellers); * Monopolistic (one seller); * <span style="color: lightgray;">Oligopolistic (a few sellers);</span> * Monopolistically competitive (many sellers of differentiated products). - The "flip side" of such markets may also be relevant (e.g., Monopsony and Oligopsony). ] --- # Perfect competition .right-column[ - For perfectly competitive markets we assume that: * there are many sellers and buyers in a market, and that each individual seller or buyer cannot influence the market; * all firms produce homogeneous product; * there are no costs for entering and leaving the market; and * the information on economic forces that are determining prices is complete and freely available for market participants. ] --- # Perfect competition .right-column[ - A perfectly competitive firm's objective is to maximize profit: `$$\max_q\pi = pq-c(q),$$` where `\(p\)` is price, `\(q\)` is output quantity, and `\(c(q)\)` is the total cost of producing `\(q\)` units of output. - The profit-maximization results in `\(p = c'(q)\)`, where `\(c'(q)\equiv MC\)`. - A perfectly competitive market is efficient, in the sense that the market equilibrium leads to the socially optimal outcome. ] --- # Perfect competition .pull-right[ <img src="04-Prices_files/figure-html/competition-1.png" width="90%" /> ] --- # Monopolistic competition .right-column[ - Monopolistic competition relaxes the assumption of product homogeneity. - There still are many sellers on the market, but each seller has an option to differentiate their product in some way or another - At the extreme, such differentiation can lead to an almost unique product, in which case the seller, in effect, becomes a monopolist. ] --- # Monopoly .right-column[ - Market structure with a single seller is called monopoly. * The assumption of product homogeneity is irrelevant. * There are insurmountable costs of entry. - A monopolist, unlike a competitive firm, is no longer a price-taker; instead, they can 'manipulate' quantity demanded by changing prices or, equivalently, they can manipulate market prices by changing output. ] --- # Monopoly .right-column[ - Thus, a monopolist's objective, like that of a competitive firm, is to maximize profit: `$$\max_q\pi = p(q)q-c(q),$$` where `\(q\)` is quantity, `\(p(q)\)` is price (as a function of quantity), and `\(c(q)\)` is the total cost of producing `\(q\)` units of output. - The profit-maximization results in: `$$p'(q)q+p = c'(q)$$` ] --- # Monopoly .right-column[ - An algebraic manipulation of the profit-maximization outcome results in: `$$p\left(\frac{1}{\epsilon}+1\right) = c'(q),$$` where `\(\epsilon\)` is the price elasticity of demand (and is negative). - This relationship suggests that when the demand is perfectly elastic, the monopoly operates as a perfectly competitive firm. - This equation also suggests that a monopoly will only operate in the elastic range of demand. ] --- # Monopoly .right-column[ - Market equilibrium under monopoly leads to an inefficient outcome, as some of the surplus—which would have been attained under a perfectly competitive market—is lost; such loss is referred to as the *dead-weight loss*. ] --- # Monopoly .pull-right[ <img src="04-Prices_files/figure-html/monopoly-1.png" width="90%" /> ] --- # Monopoly .right-column[ - A monopolist may extract profits above and beyond the 'monopoly profits', if they can exercise the *price discrimination* strategy; i.e., if they can segment the market and charge different prices. - The following conditions must be met for this: * It must be possible to identify different markets with distinct demand elasticities; * The markets must be separated—there should be no arbitrage opportunity between the markets - Under these conditions, a monopolist can further increase profits by charging higher prices in markets with less elastic demand. ] --- # Pricing Mechanisms .right-column[ - Within a market structure, prices are established or 'discovered' by means of institutional mechanisms and arrangements that facilitate the interaction between buyers and sellers. - In a perfect market, all participants have access to the same information at no cost, and hence prices reflect the existing economic conditions. As new information arrives, prices change instantly to a new equilibrium (efficient market hypothesis). ] --- # Pricing Mechanisms .right-column[ - Pricing mechanisms can influence the costs of price discovery, and therefore prices, at least indirectly though outcomes they generate. - Three broad categories of pricing mechanisms include: * negotiation - a bargaining that may be formal or informal; * auctions - a type of bidding done in a structured setting; * administering - price-setting of some sort. ] --- # Negotiated Prices .right-column[ - An informal negotiation between the involved parties is not uncommon, as it is potentially the least-cost method of price discovery for locally marketed commodities of varying quality. - A formal negotiation typically involves a union, a cooperative of farmers, who negotiate the terms of sales on behalf of individuals they represent. Such negotiation takes a structured bargaining form, and if successful, results in a contract for a specific time period that details benefits and responsibilities. ] --- # Auctions .right-column[ - Auctions is a structured framework for bidding, using clearly defined rules. - An ascending bid auction, better known as the 'English auction' is one of the most common types of auctions. The auction starts at some reservation price, and is complete once no-one is willing to bid higher than the most recent bid. Such auction, typically, leads to over-bidding—a phenomenon referred to as the 'winner's curse.' ] --- # Auctions .right-column[ - Another popular type of auction is descending bid auction, better known as the 'Dutch auction.' The auction starts at some reasonably high price, presumably such that no-one is willing to bid. The auctioneer then lowers the ask price by some increments until someone bids, at which point the auction completes. - One other popular type of auction is the sealed-bid auction, and its variant the second-price sealed bid auction, also referred to as the 'Vickery auction.' The seller accepts sealed bids; the highest bid wins but pays the price of the second highest bid. ] --- # Auctions .right-column[ - Auctions help discover prices efficiently in instances when there is no asymmetry of information among sellers and buyers, the traded good is homogeneous, and transaction costs are negligibly small. - Centralized auctions have declined for agricultural commodities where the costs of transportation, storage, and handling are considerable; local auctions remain relevant, however, as they are a convenient (least costly) site for selling livestock, for example. ] --- # Administered Prices .right-column[ - Administered prices are set—administered—by government via a regulation or policy, or by a firm's management. - In setting prices, decision makers are influenced by economic factors. But prices are decided by the decision makers' interpretation of market conditions rather than by negotiation or auctions. - Such mechanism, in certain circumstances (e.g., prices in retail stores), is the least costly mechanism. - In any case, for prices do be administered, the price setting entity (firm or government) should possess some power over a market. ] --- # Evolution of Pricing Mechanisms .right-column[ - The same commodity may be priced via different arrangements. - As the economies change, so do the pricing mechanisms. - Indeed, pricing mechanisms evolve to achieve reduction in transactions costs (broadly defined). - As a result, while negotiations, auctions, and administered pricing mechanisms remain three main institutional tools for price discovery, the outcomes of these processes alter. ] --- # Readings .pull-left[  ] .pull-right[ Tomek & Kaiser, Chapters 5 & 11 (until "Government Intervention in Pricing Agricultural Products") [Masters & Finaret, Chapter 3](https://link.springer.com/chapter/10.1007/978-3-031-53840-7_3) (Section 3.1) [Masters & Finaret, Chapter 5](https://link.springer.com/chapter/10.1007/978-3-031-53840-7_5) (Section 5.1) ]