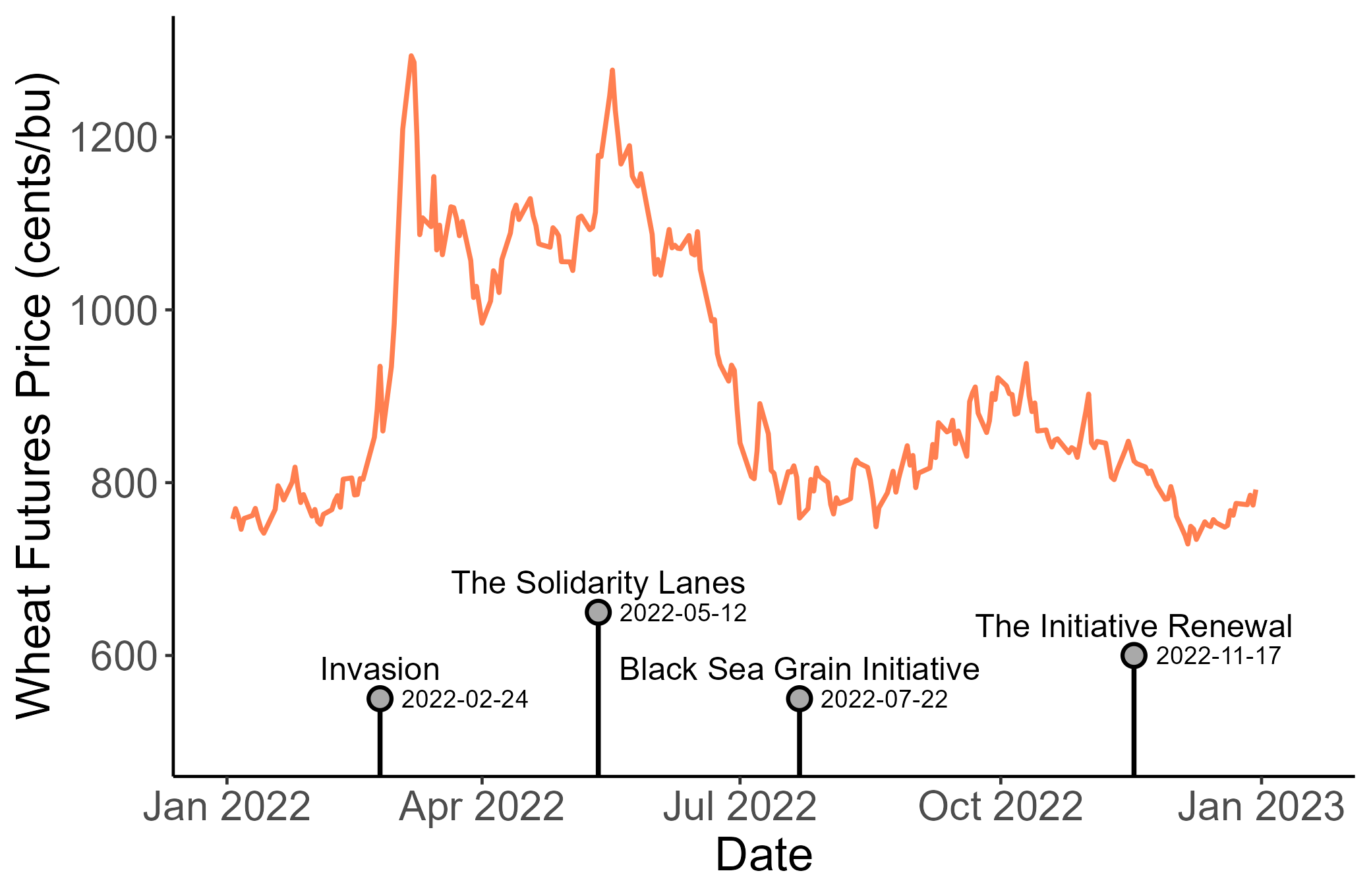

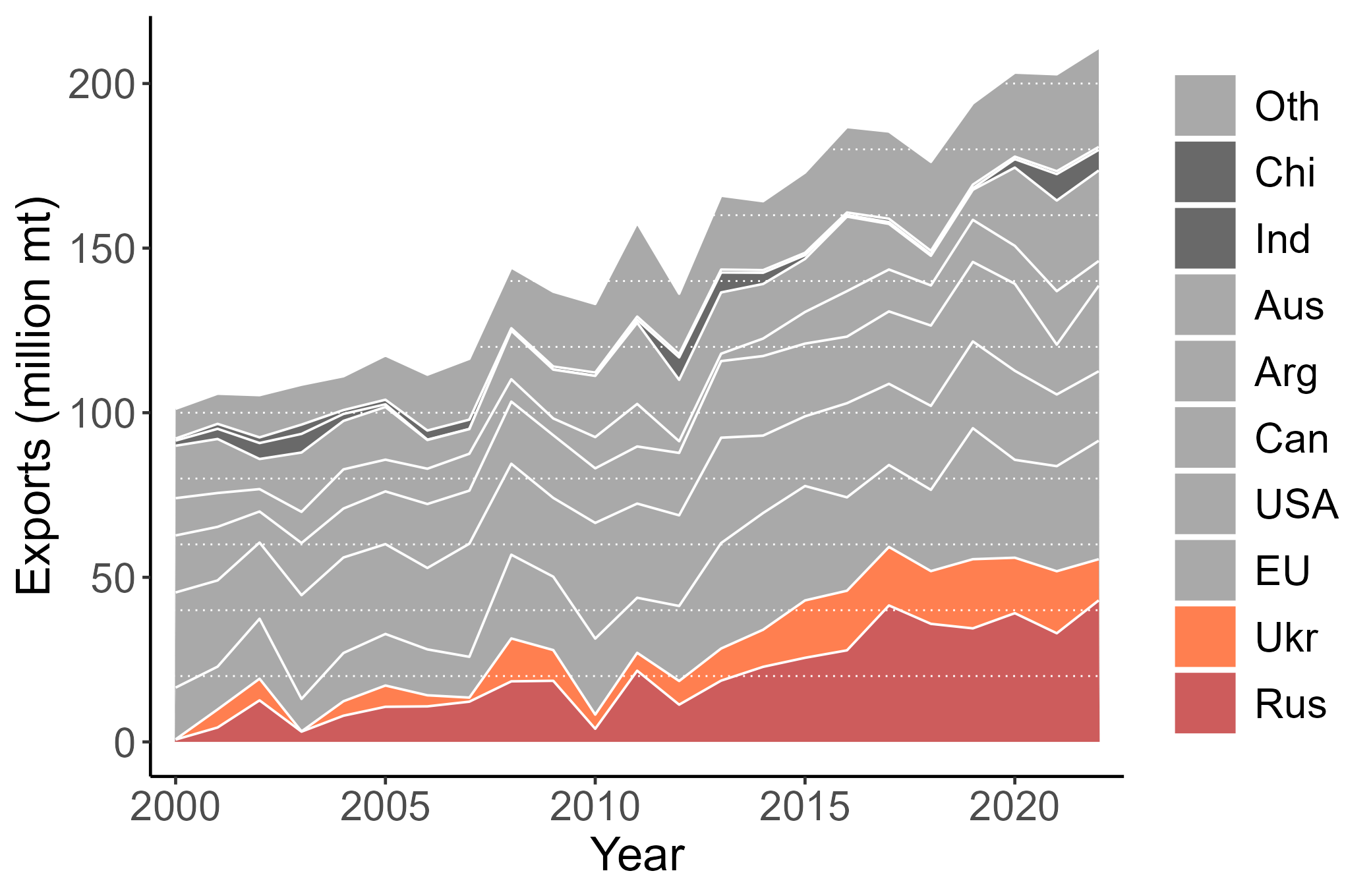

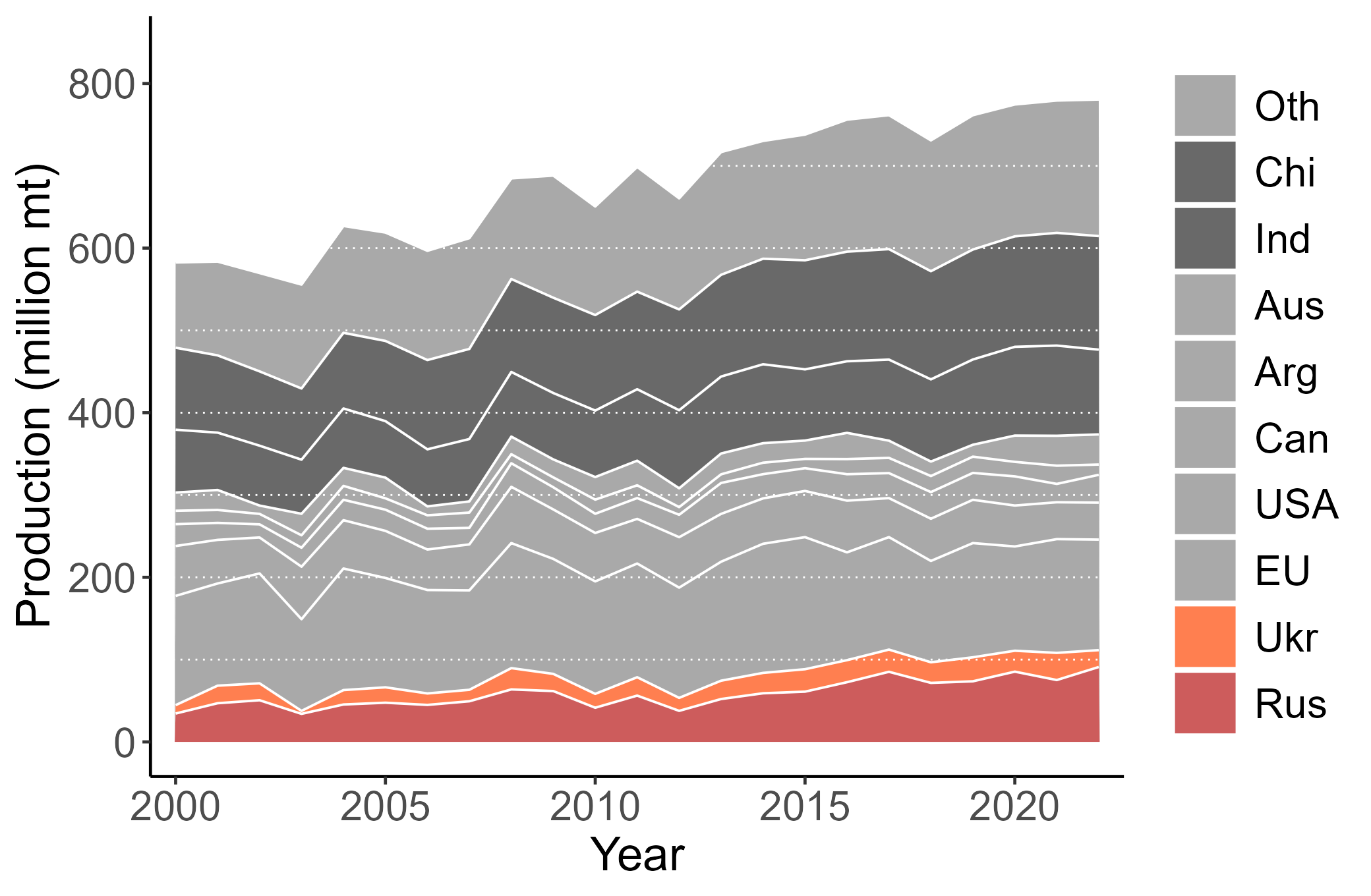

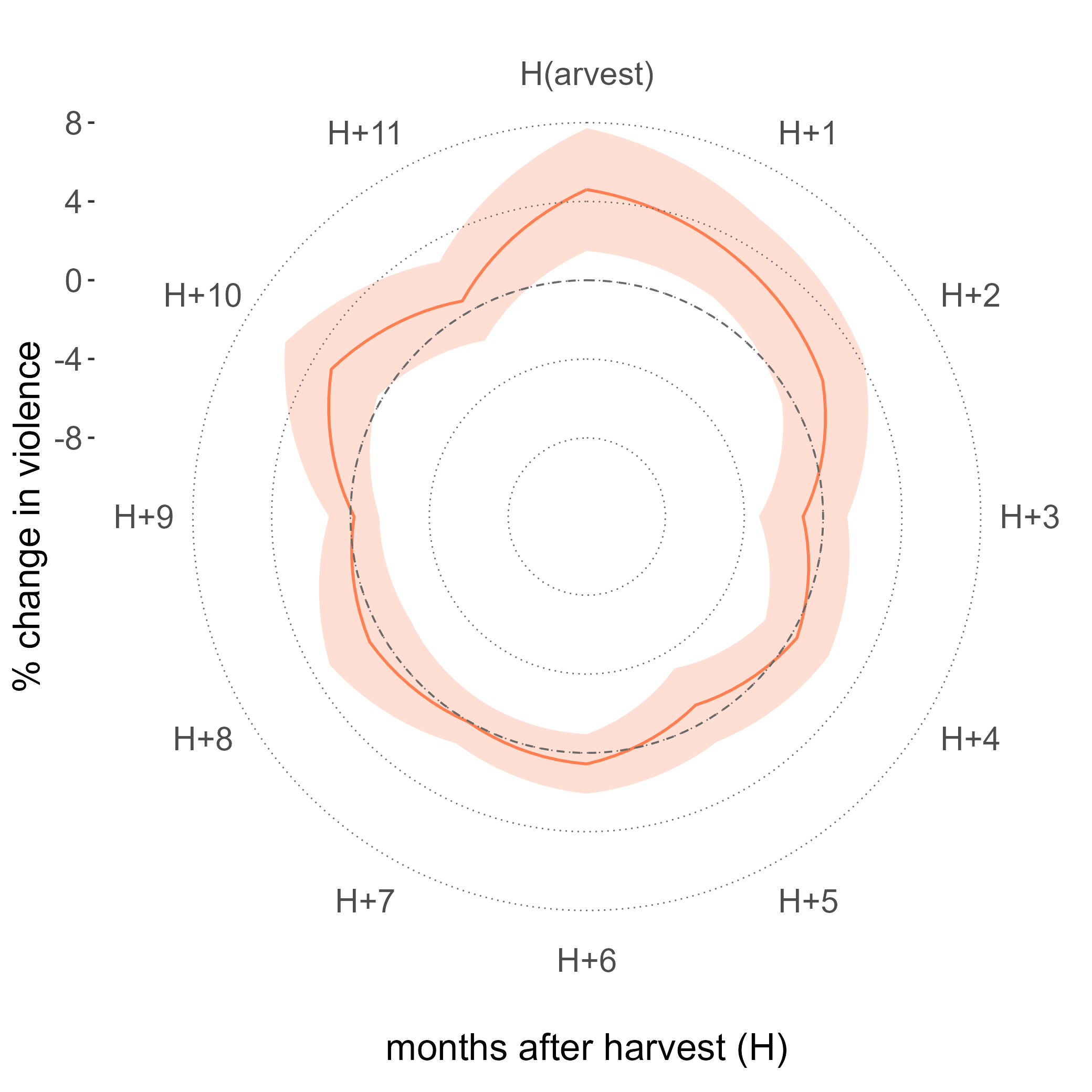

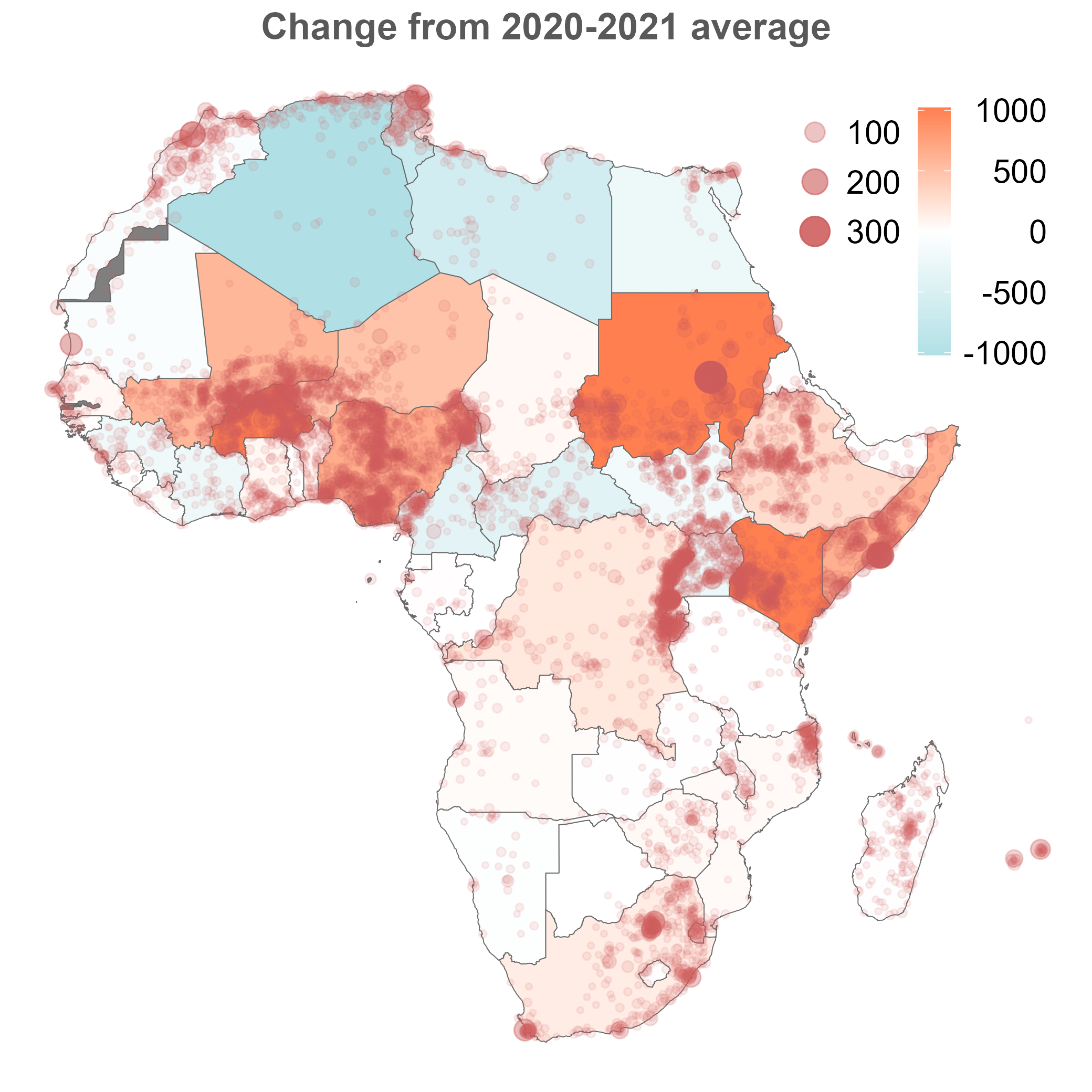

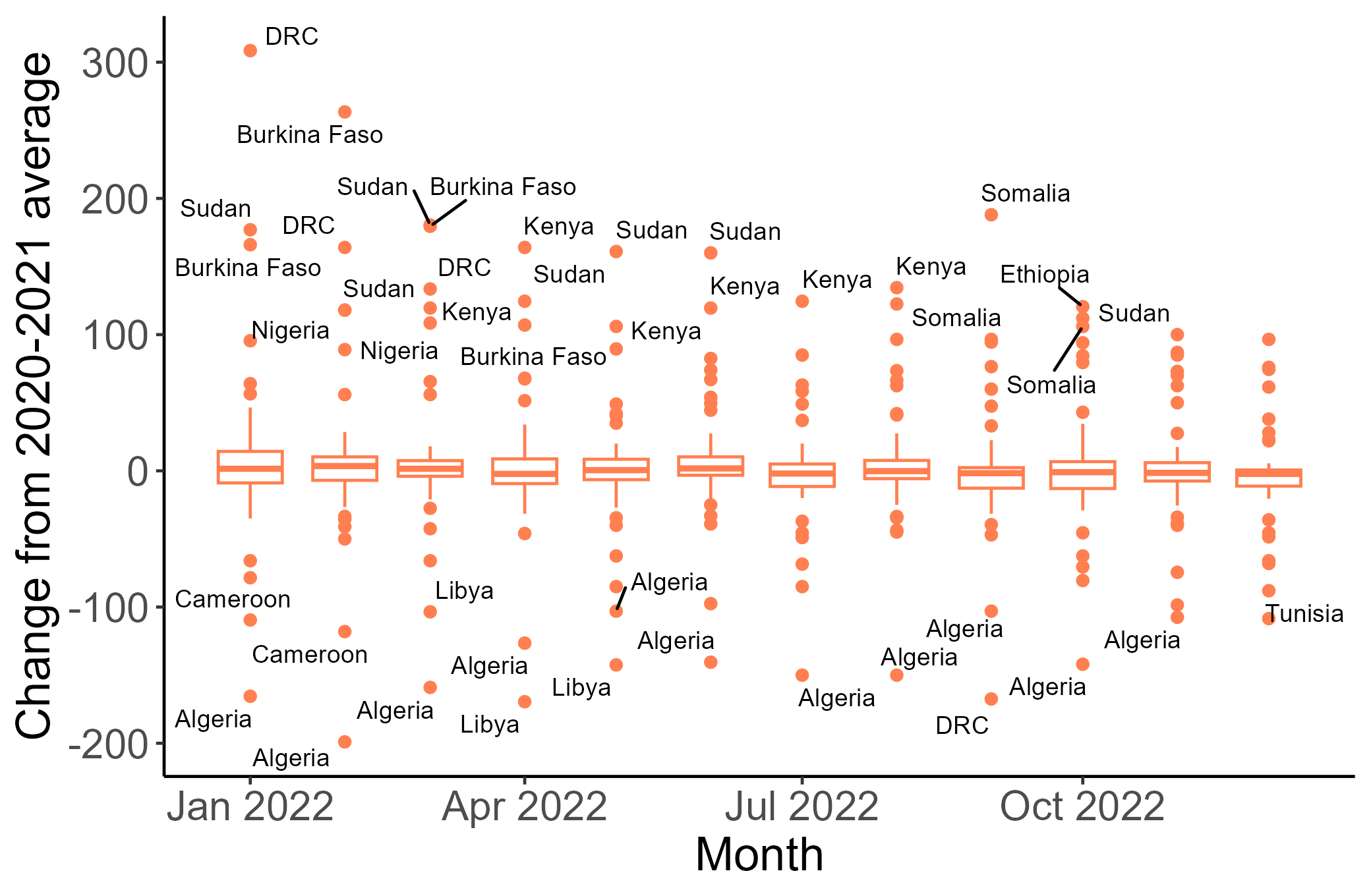

class: center, middle, inverse, title-slide .title[ # War in Ukraine and Disrupted Markets ] .author[ ### David Ubilava ] .date[ ### University of Sydney ] --- # Turbulence in agricultural markets .right-column[ Much has been said and [written](https://theconversation.com/russias-war-on-ukraine-is-driving-up-wheat-prices-and-threatens-global-supplies-of-bread-meat-and-eggs-178879) about soaring prices of wheat (and other key cereals) and the repercussions of this price surge from March 2022 onward. This presentation is (loosely) based on [Ferguson and Ubilava (2022)](https://doi.org/10.1111/1467-8489.12497). ] --- # Wheat futures during the war and agreements .pull-left[ - Wheat prices surged at the onset of the war. - War-induced market disruption and the sanctions that followed were both at play. - The agreement on "grain corridor" reverted prices to the pre-war levels. ] .pull-right[  ] --- # Trends in wheat exports .pull-left[ - Russia and Ukraine account for more than a quarter of world wheat exports. - These exports are at par with combined exports from EU and the USA -- the two major wheat-exporting regions. ] .pull-right[  ] --- # Trends in wheat production .pull-left[ - Russia's and Ukraine's share in world wheat production is smaller but still substantial. - China and India are notable producers as well as consumers of wheat. ] .pull-right[  ] --- # Russian wheat export bans .right-column[ This is not the first time a large exporting country, such as Russia specifically, has restricted its exports. - In 2010, in the wake of the drought-induced poor harvest, Russia banned wheat exports for the reminder of the year, and then extended this ban for the first half of 2011. - During the 2007-2008 commodity price boom, Russia imposed an export tax of up to 40 percent; in 2015, Russia imposed an export tax of 15 percent with an additional payment of 7.5 Euros/ton. ] --- # Causes of the market disruption: Weather .right-column[ Climate and prices are linked through the weather—production—prices channel. Two aspects of this relationship are of note: - Because cereal grains are harvested annually, the effect of the weather shocks on production also is manifested at annual frequency. However, the expectations about the yields are formed at higher frequency, and updated regularly via information shocks. - Globally, weather shocks and harvest periods are not synchronized due to geographical disparities in weather as well as seasonal differences between northern and southern hemispheres. ] --- # Causes of the market disruption: Energy .right-column[ Energy and food markets are linked. Higher energy prices impact agricultural markets through input and transportation costs. Increase in international freight rates, for example, were a notable factor that led to growing commodity prices from 2021 onward. ] --- # Causes of the market disruption: Policy .right-column[ Government interventions tend to be featured prominently during food price spikes. Reactive policies amplify shocks. - Changes in trade restrictions by several major rice producing countries have largely led to the 2008 global rice crisis. - The 2010 export ban by Russia exacerbated the global wheat shortage due to the weather-related poor harvest in the country. - The 2022 export ban by India, triggered by the political shock and the related disruptions, contributed to the surging wheat prices. ] --- # Causes of the market disruption: Other .right-column[ The invasion of Ukraine is a case of a geopolitical event that triggered a significant spike in commodity prices—primarily of cereal grains and, to some extent, of vegetable oils as well. The Covid-19 pandemic had a limited *initial* impact on world food commodity prices, partly due to surprisingly resilient global food supply chains. Over time, constant disruptions and increased uncertainty contributed to what shaped up as the 2022 food crisis. ] --- # Causes of the 2022 Food Crisis .right-column[ - Strong demand and high energy prices (similar to previous crises of 2007-2008 and 2010-2011). - Trade disruption due to the Ukraine War (unique to this crisis). - Mild-to-moderate impact from "production issues" and "trade restrictions" (unlike previous crises). ] --- # Consequences of the market disruption .right-column[ The global commodity price shocks matter because they drive food prices in many countries. Not all countries are affected the same way, however. The transmission of price shocks from global to local markets is not perfect, nor homogeneous across countries or markets within the countries. ] --- # Consequences of the market disruption .right-column[ Two dimensions of the price transmission from global commodity markets to local food markets are of importance. - Horizontal price transmission - integration of local markets with global markets. - Vertical price transmission - locally, the pass-through of the price of a commodity to the price of a derived food item. ] --- # Consequences of the market disruption: Poverty .right-column[ Soaring food prices affect the poor of low and middle income countries as they pose risk on the food security—a considerable reduction of caloric intake as well as the dietary diversity. In these countries, repercussions are more dire for urban population compared to rural population who may even benefit from increase in commodity prices if they produce these commodities. Among these countries, less affected are land-locked countries, or places located inland, where the global-to-local price transmission is somewhat muted. ] --- # Consequences of the market disruption: Conflict .right-column[ One of the effects of increasing food prices is the elevated risk of social unrest and civil conflict. - Soaring wheat prices in the second half of 2010 partly contributed to the 2011 Arab Spring—the political turmoil that spanned nearly all wheat-importing countries of the Middle East and North Africa (MENA) region, ousting governments and leading to several civil wars in years to follow. Feedback: conflict (in one region) fuels conflict (in other regions). ] --- # Consequences of the market disruption: Conflict .right-column[ For urban consumers, who are not involved in agricultural production, an increase in the price of a food item will reduce real income. In such instances, social unrest of some form (e.g., protests, riots), fueled by people's inability to satisfy their basic needs, is expected. ] --- # Consequences of the market disruption: Conflict .right-column[ For rural consumers, and specifically those engaged in agricultural activities, an increase in the price of a commodity can have a positive or negative income effect, depending on whether they also produce or merely consume the commodity. ] --- # Consequences of the market disruption: Conflict .right-column[ When an increase in commodity prices is income-enhancing, two effects of opposite sign are possible. - One the one hand, higher farm income increases the opportunity cost of fighting, thus reducing conflict. - On the other hand, higher farm income increases opportunities for appropriation of the agricultural surplus, thus facilitating conflict. ] --- # Consequences of the market disruption: Conflict .left-half[ - [Ubilava et al. (2023)](https://doi.org/10.1111/ajae.12364) investigate the effect of global cereal price increase on seasonal violence in Africa. - The key finding is that much of the annually accrued effect—which is positive, statistically significant, and economically meaningful—manifests during the first three months of the crop year. ] .right-half[  ] --- # Conflict in Africa in times of the Ukraine war .left-half[ - More conflict in sub-Saharan Africa, including in countries that import grain from the Black Sea region. - Less conflict in North Africa, which has been historically prone to supply shortages from the Black Sea region (Arab Spring 2011). - These changes are relative to the 2020-2021 average. ] .right-half[  ] --- # Conflict in Africa in times of the Ukraine war .pull-left[ - More conflict, after the invasion, in Kenya, Somalia, Ethiopia. - "Pre-trends" in Sudan, Burkina Faso. - Less conflict in Algeria (leading to and after the invasion). ] .pull-right[  ] --- # Key takeaways .right-column[ - The global commodity market disruption, due to the Ukraine War, had a transitory effect of commodity prices. - It may have triggered the early onset of the global food crisis. - Both costs and opportunity costs are at play. ] --- # References .right-column[ - Ferguson, S., and D. Ubilava (2022). [Global Commodity Market Disruption and the Fallout](https://doi.org/10.1111/1467-8489.12497). Australian Journal of Agricultural and Resource Economics 66(4), 737-752 - Ubilava, D., Hastings, J.V., and K. Atalay (2023). [Agricultural Windfalls and the Seasonality of Political Violence in Africa](https://doi.org/10.1111/ajae.12364). American Journal of Agricultural Economics (in press) ]